2 Gharamah penalty which is the difference between the AFR and the Tawidh rate of 10 or IIMM Rate. This will cover all physical cash transactions ie.

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

This amount cannot be recognised as your income as it is an amount outside the agreed Aqad so it must be given to charity.

. In conventional banking interest is charged when it comes to the lending of money and banking products involving investments in order for the bank to make money. Although essentially both Takaful and conventional life insurance serves the same purpose of providing coverage there are major differences between the two as can be seen below. Islamic banking Islamic finance Arabic.

Flexibility - Hassle free to make extra payments and withdrawal from your current account. Shariah-compliant it must adhere to all Islamic laws and not involve anything Haram. He was also conferred the Banking CEO of the Year Malaysia 2020 Award by.

For daily usage Earn daily returns on your balances and use it to make payment. If you are an existing Online Banking user you dont need to register again. الاقتصاد الإسلامي refers to the knowledge of economics or economic activities and processes in terms of Islamic principles and teachings.

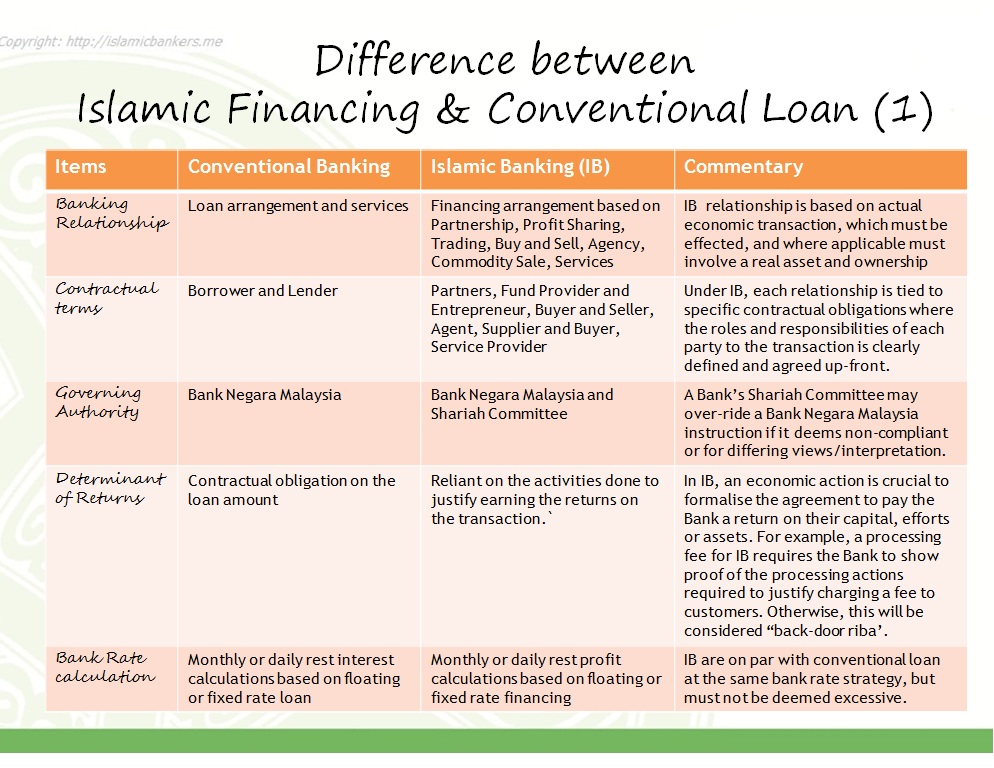

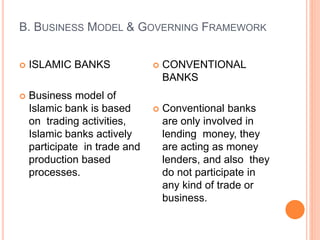

More often than not most conventional banks in Malaysia have an Islamic banking arm. The primary difference lies in the element of interest earned andor charged by the bank. For Islamic banks to a make profit and to satisfy the borrowers needs of cash they have to conduct transactions that do not violate Islamic rules by looking for allowed contracts that can achieve the required goal.

Enter your DebitATM Card PIN. However the differences between Islamic and conventional insurance are found mainly in their. You can use your existing Online Banking Username and Password to login.

Insurer and the participants under conventional it is the insured or the assured. This study makes a case for takāful as complimentary to conventional insurance. Mostly they are based on sale and purchase transactions accompanied by a degree of risk.

Investing in Principal e-Cash Fund through GO. 60 less 312 218 must be given to charity as you cannot recognise it as. مصرفية إسلامية or Sharia-compliant finance is banking or financing activity that complies with Sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture.

The key difference between Takaful and conventional insurance rests in the way the risk is assessed and handled as well as how the Takaful fund is managed. However this insurance coverage will be restricted when the new framework for deposit accounts takes effect in tandem with the phasing out of Mudharabah GIA under the Islamic Financial Services Act 2013. Consumer-to-consumer entity-to-entity entity-to- consumer vice versa.

Further differences are also present in the relationship between the operator under conventional insurance using the term. The cash transaction limit is a limit on physical cash transactions while the CTR refers to the obligation of reporting institutions eg. There are five main contracts in Islamic finance.

What is the difference between investing with Principal through GO and GOinvest. Ability to pay-off loan faster - With lower interest cost payable the loan tenure will be shorten. Cost savings on interest - With the concept and illustration above whenever you deposit or save into your current account your loan interest will be reduced.

Whats the difference between the cash transaction limit and the cash threshold report CTR. Enter your DebitATM Card Number. Islamic banking in Pakistan appears to be unstoppable while conventional banking deposits grew an average of 13 percent annually Islamic banking deposits have grown by 42 percent in the same.

If you are not an existing Online Banking user you can register for using this site in 5 easy steps. The aim of this study is to compare and contrast conventional insurance policies from Islamic insurance policies takāful using a qualitative method consisting of a descriptive and narrative analysis. Eqhwan has received a number of awards such as the Islamic Banker of the Year 2019 and CEO of the Year 2021 from the Global Islamic Finance Awards and was named as the Best Islamic Banking CEO Malaysia by Global Banking and Finance Review for 3 consecutive years ie.

And the IIMM Rate is 312 the 218 ie. So if the AFR is 60 pa. For savings An option for you to save and invest your money.

Therefore it has its own economic system which is based on its philosophical views and is compatible with the. Investing in Principal Islamic Money Market Fund through GOinvest. Islam has a set of special moral norms and values about individual and social economic behavior.

Islamic banking in Malaysia is also covered under the Perbadanan Insuran Deposits Malaysia. The difference between Takaful and Conventional life insurance.

The Difference Between Conventional And Islamic Fixed Deposits

Differences Of Components In Balance Sheet Of Islamic And Conventional Download Table

Conventional Banking Islamic Bankers Resource Centre

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

Pdf Comparative Performance Study Of Conventional And Islamic Banking In Egypt Semantic Scholar

Lecture 2 Conventional Banking And Islamic Banking Systems

Conventional Banking Islamic Bankers Resource Centre

Difference Between Islamic Banking And Commercial Banking Features

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

Pdf An Empirical Investigation Into The Problems And Challenges Facing Islamic Banking In Malaysia Semantic Scholar

Icb Islamic Bank Job Circular 2018 Job Circular Bank Jobs Islamic Bank

Pdf Research On Islamic Banking In Malaysia A Guide For Future Directions

A Comparison Between Malaysia And Indonesia In Islamic Banking Industry Semantic Scholar

Pdf An Empirical Investigation Into The Problems And Challenges Facing Islamic Banking In Malaysia Semantic Scholar

Islamic Subsidiary Islamic Bankers Resource Centre

Islamic Banks Vs Conventional Banks

Islamic Banking And Conventional Banking Modernalternativemama Com